Fraser Valley real estate sales record slowest annual start in ten years; January new listings lowest in over thirty years

The January statistics released by the Fraser Valley Real Estate Board indicate that the market is continuing to cool with lower sales than in December. The narrative on the street is quite different though, as there seems to have been a shift mid-month. In most sub-markets and for most product types, the number of showings have increased dramatically, offers are starting to come together, and we are even seeing multiple offers again on occasion. This can likely be attributed to three main factors. 1) Pent up demand is being released, as a lot of buyers took a step back and sat on the sidelines through November and December and are now jumping back in. 2) Consumer confidence may be shifting in a positive direction with the Bank of Canada’s interest rate announcement in January. 3) New listings were at the lowest level for a January since 1984, so of course the current listings are getting a lot of attention, because there aren’t many options. Is this a sign of things turning around and a stronger Spring market? Have we reached the bottom? Change brings on many good questions like these. Give us a call to run through things and see how this impacts you.

See Listed Properties For Sale in Langley BC

If you are considering selling, buying or just have questions about the market, please give us a call today and let’s chat.

What Does The Fraser Valley Real Estate Board Have To Say?

Fraser Valley real estate sales record slowest annual start in ten years; January new listings lowest in over thirty years

SURREY, BC – The downward trend in Fraser Valley real estate sales continued in January as further interest rate hikes kept buyers sidelined.

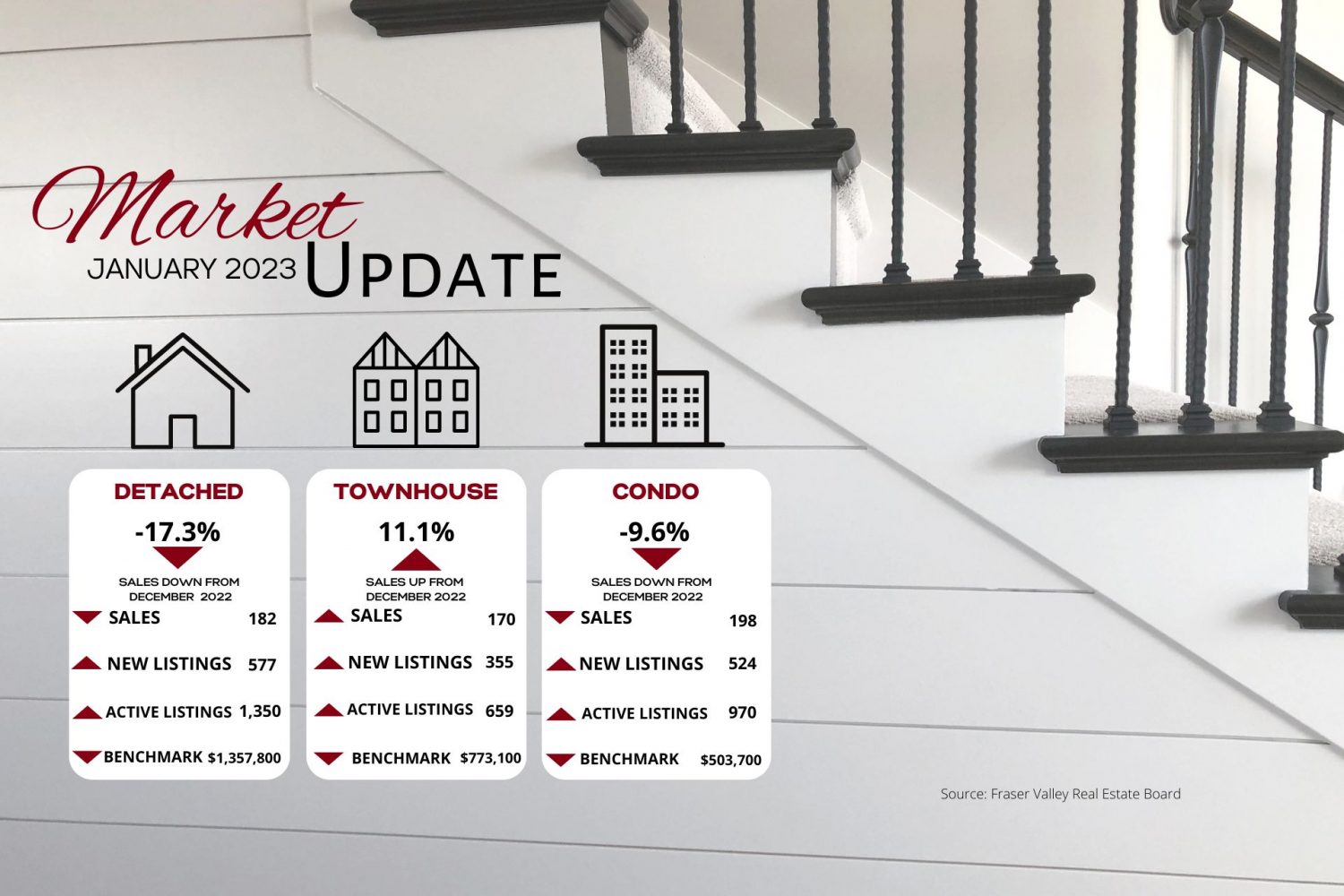

With 626 transactions processed on the MLS®, sales were off by 12.6 per cent compared to last month and down by 52.2 per cent compared to this time last year. The last time January sales were this low was in 2013 at 617 sales.

“Buyers are understandably cautious, which explains the slow start to the year,” said Sandra Benz, President of the Fraser Valley Real Estate Board. “That said, the pent-up demand that has been building since the last quarter of 2022 will likely give rise to a sales uptick, especially if rate hikes subside, which we expect will be the case.”

Although new listings saw an increase of 128.3 per cent over last month to 1,833, they are at the lowest level of new supply for January since 1984. Active listings rose slightly up 5 per cent to 4,118 over December 2022 and up by 76.6 per cent compared to this time last year.

“We also expect inventory to start increasing over the coming months as sellers act on decisions that have been on hold, waiting for rates to peak” added Benz. “As we start to see greater selection across all property categories, we should see demand pick up.”

At $942,200, the composite Benchmark home price continued to edge downward, slipping by 1.4 per cent from December and off by 15.1 per cent compared to January 2022.

“After a market slowdown for the past several months, the Board is expecting a return to seasonal activity leading into spring,” said FVREB CEO Baldev Gill. “With rates still elevated, however, buyers and sellers would be welladvised to seek out the guidance of a professional REALTOR® to determine the best strategy and timing to take advantage of the anticipated market upswing.”

Across Fraser Valley in January, the average number of days to sell a single-family detached home was 48, and a townhome was 40 days. Apartments took, on average, 41 days to sell.

MLS® HPI Benchmark Price Activity• Single Family Detached: At $1,357,800, the Benchmark price for an FVREB single-family detached home

decreased 1.4 per cent compared to December 2022 and decreased 17.6 per cent compared to January 2022.

• Townhomes: At $773,100, the Benchmark price for an FVREB townhome decreased 1.8 per cent compared to

December 2022 and decreased 8.8 per cent compared to January 2022.

• Apartments: At $503,700, the Benchmark price for an FVREB apartment/condo decreased 0.2 per cent

compared to December 2022 and decreased 5.9 per cent compared to January 2022.

Find the January 2023 Statistics Package HERE.